What's the deal?

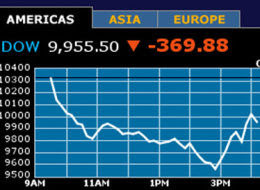

It's so strange: all the time we hear how bad the economic crisis is and what a disaster could happen any moment from now, and still life goes on as if nothing changes. At least, for me and my fellow students at George Washington University. In other places in the US, for example in the mid-west, people already felt the economic downturn long ago when they couldn't afford their mortgage anymore. In that respect, it's also strange that rescue is only offered once big corporations ask for it. I'm convinced that the €700 billion bailout is necessary to safeguard the deposits, investments, retirement funds and access to capital of millions of people in the US and worldwide, but it's striking that it's only offered now, and not when people started defaulting on their loans. Now, banks are compensated for the huge, massive-scale mistakes they made, while this whole crisis might have been contained if consumers would have been compensated long ago (when the house-market started to crumble) for their overstretched mortgages. Now we all have to pray the bailout will actually have the desired effect. It seems that traders on Wall Street aren't convinced, regarding the 300-point decrease below the 10.000 points, for the first time in four years. In the meanwhile politicians keep seizing this historic moment to rally support for their (in)action and create adversity against their enemies: senators pound their chests saying how great it is that they actually passed this bill (did they really have a choice?), McCain and Palin keep attacking the democrats on any topic they can come up with - and they don't seem all too creative - and Obama calls McCain 'out of touch' with the present economic situation. He might be, but who actually really understands what is going on? One of my professors at GW said she just doesn't know how all this will work out, and when a correspondent from the Financial Times came to our classroom after spending the whole day on Capitol Hill, not much of our confusion was clarified.

It's so strange: all the time we hear how bad the economic crisis is and what a disaster could happen any moment from now, and still life goes on as if nothing changes. At least, for me and my fellow students at George Washington University. In other places in the US, for example in the mid-west, people already felt the economic downturn long ago when they couldn't afford their mortgage anymore. In that respect, it's also strange that rescue is only offered once big corporations ask for it. I'm convinced that the €700 billion bailout is necessary to safeguard the deposits, investments, retirement funds and access to capital of millions of people in the US and worldwide, but it's striking that it's only offered now, and not when people started defaulting on their loans. Now, banks are compensated for the huge, massive-scale mistakes they made, while this whole crisis might have been contained if consumers would have been compensated long ago (when the house-market started to crumble) for their overstretched mortgages. Now we all have to pray the bailout will actually have the desired effect. It seems that traders on Wall Street aren't convinced, regarding the 300-point decrease below the 10.000 points, for the first time in four years. In the meanwhile politicians keep seizing this historic moment to rally support for their (in)action and create adversity against their enemies: senators pound their chests saying how great it is that they actually passed this bill (did they really have a choice?), McCain and Palin keep attacking the democrats on any topic they can come up with - and they don't seem all too creative - and Obama calls McCain 'out of touch' with the present economic situation. He might be, but who actually really understands what is going on? One of my professors at GW said she just doesn't know how all this will work out, and when a correspondent from the Financial Times came to our classroom after spending the whole day on Capitol Hill, not much of our confusion was clarified.And I'm getting more and more confused. Trying to keep track of the ownership of the Dutch part of ABN AMRO, I couldn't believe what I heard when I found out that the Dutch Minister of Finance Wouter Bos actually bought the Dutch part of both ABN and Fortis! As if nationalizing one of the biggest bank/insurance companies of the country is something you can do in a few days (cause that's how much time it took to close the deal). Even more unsettling was the fact that the Volkskrant (a nationwide newspaper in the Netherlands) called this his Glorious Week. Now let's get some things straight: he was the one who could have stopped Fortis from taking over ABN AMRO, and now they say he's succesfull when he buys 'back' ABN AMRO, completely stripped of its international network by Royal Bank of Scotland and Santander? And while he claims that he acquired the 'healthy' part of ABN AMRO and Fortis, I sincerely doubt is judgement after he considered the takeover of ABN AMRO not harmfull for the Dutch economy and refused to veto it. Now he has to spend some 20 billion dollars on a slice of what used to be Netherland's biggest bank and a part of the Belgian banker/insurance company Fortis, while some departments have already been split off for sale to other parties (Deutsche Bank and BNP Paribas) and others are halfway some seperation/intergration process that is now more and more looking like McCains healthcare plan (according to Biden 'the ultimate bridge to nowhere'). Yeah, I'm sure Bos did a great purchase.

When looking at the data I found out something interesting: the $700 bailout in the US represents about 5% of the American GDP (of 2007). No wonder that both Senate and Congress wanted to have their say and make sure the bailout would be in the best interest of the American people. Since most will be spend on non-performing American loans, the biggest part of the bailout will be directly injected into the US economy.

The takeover of ABN/Fortis cost the Dutch state some 3% of its GDP of 2007, so that's also a considerable amount. I haven't followed the news very closely all the time, but judging by the speed at which the deal was closed, I don't think the Dutch parliament really had a chance to look at the details. And the money didn't even go to Dutch taxpayers: it was paid to the owners of the company, the Belgian Fortis Group, the French BNP Paribas and the Belgian state. Three percent of the Dutch GDP out of the country, just like that. As a comparison: the Netherlands spend about 0.7% of its GDP on development assistance. Bos probably assumes he will be able to sell the bank/insurer with a considerable profit, but as I said, I'm not so sure about his economic insight anymore. What a democracy we live in!

0 Comments:

Post a Comment

<< Home